In our recently published book, Flight of the Golden Geese[1] (co-author David Lesperance), we describe the requirements for a Smart Region, that is any nation-state/state/area/town/suburb that is optimized to succeed in the globalized and networked world of the twenty-first century. The Smart Region is right-sized, and is particularly attractive to both major corporations and high net worth individuals.

The importance of these regions is a recognition that age of mass production is over; success in the twenty-first century requires a specialized and focused production facilitated by talent workers, not a semi-skilled and unskilled workforce, or by a bloated public sector. And yet it is the preferred voters of these three groups that self-indulgently drive the political imperative, and insist on `fair`, that is excessive taxation of the wealthy.

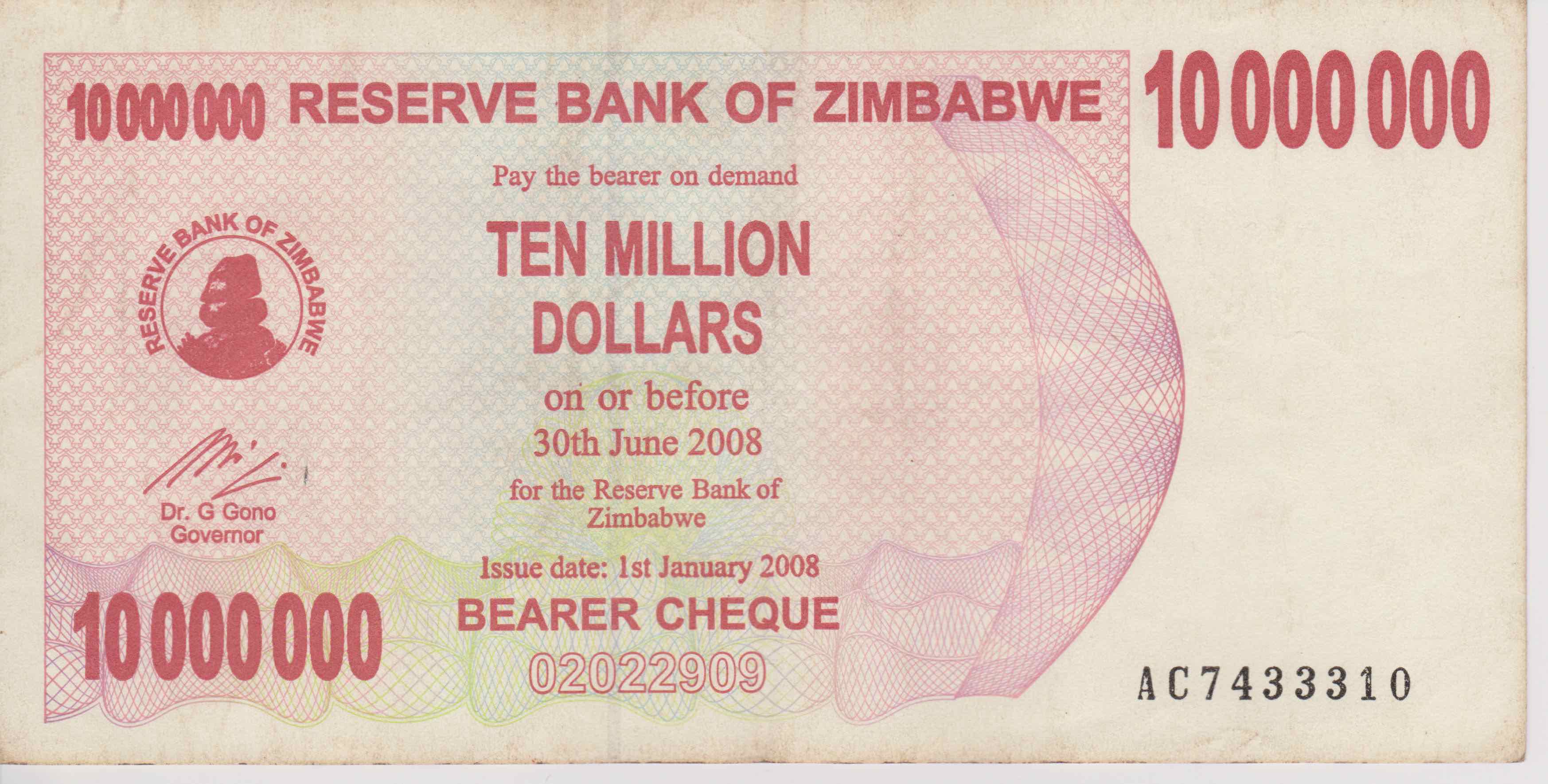

The blatant behavior of tax authorities to treat the minority of hard working wealth creators as ‘taxation in waiting’ is a sure and certain sign of a country on the slide. Greed over an excessive tax-take blinds their political masters to the long-term consequences of their actions. Because the targets of taxation will no longer remain passive, as the country reaches a tipping point.

Consider today’s USA where there are nearly twice as many `workers` in government (22.5 million) than in all of manufacturing (11.5 million)[2]. In 1960, there were 15 million in manufacturing, and only 8.7 million paid by government. The IRS is driving out America’s super-rich. Three thousand Golden Geese left their shores last year because of taxation[3].

The unsentimental words of the nineteenth century philosopher Friedrich Nietzsche come to mind: “Many too many are born. The state was devised for the superfluous ones”[4].

Of course any real world incarnation of the Smart Region will always fall short of perfection, but hopefully by not too great a margin. In order to be attractive to wealth creators, the smart region should implement policies, particularly tax policies, that expand its critical mass of scientific, technological and commercial expertise, underpinning it with an effective education system, and highly selective immigration policy that regenerates and/or develops a top quality human resource.

Most importantly the tax policies must be attractive, and fair to all (including the wealthy). The problem is that the commonly accepted definition of ‘fair’ among populist politicians is usually totally unfair to the rich – in many countries even the thought of being fair to the rich is met with derision. “Don’t tax you, don’t tax me. Tax that fellow behind the tree.”[5]

The prevalent political rhetoric moralizes about taxation. How easily they forget Learned Hand’s famous words : “over and over again courts have said that there is nothing sinister in so arranging one’s affairs as to keep taxes as low as possible. Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands: taxes are enforced exactions, not voluntary contributions. To demand more in the name of morals is mere can’t.”[6]

Of course “Taxes are what we pay for civilized society.”[7] Also “The power of taxing people and their property is essential to the very existence of government.”[8] Although my old colleague at the London School of Economics Ken Minogue[9] would probably have phrased this differently: “The purpose of government is to raise taxes to pay for government.”

The questions remain: who pays? how much? and in what way? A Smart Region will be right-sized, with the taxpayers outnumbering the tax-takers. In that way taxes will stay low. Their rnlightened governments avoid getting involved in anything that doesn’t concern them. A shrinking government means shrinking deficits. But of course there has to be some taxation.

Nothing has changed. Colbert[10] was clear about this way back in seventeenth century France, “The art of taxation consists in so plucking the goose as to obtain the largest possible amount of feathers, with the smallest possible amount of hissing”.

If the hissing reaches a cacophony, then as we predict in Flight of the Golden Geese, these globally mobile group of disillusioned taxpayers will fly away. This one percent of the population regularly pays over a third of personal taxes. If they feel that the taxes are prices worth paying in return for the benefits that accrue, then they will stay, all is well, and the economy enters a virtuous circle. If they resent paying, then they will opt out, and a vicious circle beckons.

As Thomas Jefferson explained: “Merchants have no country. The mere spot where they stand on does not constitute so strong an attachment as that from which they draw their gain.”[11] So how does the state ensure a strong attachment? By developing a taxation model that is appropriate to all, and not just to its vocal majority.

To answer the question of an appropriate level of taxation, what better place to start than with Adam Smith’s Wealth of Nations[12]. In Book Five, Chapter 2, paragraphs 25–28, Smith outlines his four maxims for fair taxation. These can be summarized under the headings: equanimity, certainty, convenience, and economy. I would add two more: simplicity and necessity.

• Equanimity: every citizen/company in the jurisdiction should contribute, but in proportion to their respective abilities to pay; those in similar positions should pay similar amounts.

• Certainty: there should be no arbitrary taxation; and the mode of the tax demand, and the timing of collection should be predictable.

• Convenience: tax should be easy to understand, clear in application, easy to calculate, and payment easy to collect at a time appropriate to the payer.

• Economy: the cost of collection should be as low as possible, utilizing the fewest officers and inspections, and the scale taxation should not distort the economy or discourage enterprise and effort.

• Simplicity: part of the problem with taxation is the cost of compliance. By making the tax rules as simple as possible this waste of time and money can be reduced, all promoting a virtuous circle. The taxes coming out of Westminster and Brussels are seen as a denial of service attack on business.

• Necessity: tax will go to pay only the government expenditure that is absolutely necessary. Charity begins at home. Vain politicians must not be allowed to preen and posture on the world stage, and involve the state in vastly expensive foreign (mostly military) misadventures, and the doling out of largesse to preferred voters.

Sadly few modern nation-states conform to these simple rules, and everywhere vainglorious government are squandering scarce resources, and placing their tax base at risk. Because globalization has changed the nature of trade. Today’s transnational company has decentralized and distributed itself around the globe, becoming a ‘virtual enterprise’ – project-based, and networked around global information systems. Consequently, companies have access to a billion new unskilled/semi-skilled workers, and so will choose to subcontract the requisite labour rather than employing it in-house. Thus labour has become a commodity despite all the denials coming out of the OECD, and so must compete on price; hence the rush to off-shoring of production jobs from the US and other developed countries. Consequently, the impending curse of mass unemployment will affect every unprepared nation-state. Taxation will be part of the equation.

Innovative firms and entrepreneurial individuals will cluster in smart regions, the very concentration acting as a magnet for established innovators and a spur for new enterprise. “Spectacular growth comes from these self-perpetuating hot-spots that thrive on their own energy. This energy drives a rapid, almost uncontrolled diffusion of technological techniques and knowledge. The hot spot itself fuels the engine of endogenous growth by delivering innovation. But only within a network of trust relationships, where only invited talent is allowed to join in an institutional environment that both mobilizes the intellectually gifted, and promotes and finances entrepreneurial activity by delivering the right incentives.”[13]

The Golden Geese (their wealth and companies) are indifferent to, and unhindered by (national) boundaries and barriers. They identify only with regions that serve their particular interests, and then only temporarily; they will walk away from a region just as easily as they entered it. The Smart Region uses its tax policies to make itself commercially and socially attractive to the migrating Golden Geese, who are transnational and relocate physically, fiscally and electronically to where the profit is greatest and the regulation/taxation least.

Ian O. Angell

REFERENCES

1. Angell I.O. & Lesperance D.S. (2015), Flight of the Golden Geese, Bullhorn Press, Boston, MA.

2. S. Moore (2014), `We’ve Become a Nation of Takers, Not Makers`, WSJ April 1.

3. https://www.federalregister.gov/quarterly-publication-of-individuals-who-have-chosen-to-expatriate

4. Nietzsche, F. (1969), Thus Spake Zarathustra, translated by Hollingdale, R.J., Penguin Books, London

5. Russell B. Long (1948-1987), U.S. Senator for Louisiana.

6. Billings Learned Hand (1872-1961), U.S. Judge and judicial philosopher.

7. Oliver Wendell Holmes Jr. (1809-1894), U.S. Supreme Court Justice.

8. James Madison, the 4th President of the United States.

9. Emeritus Professor of Political Science, London School of Economics.

10. Jean-Baptiste Colbert was French King Louis XIV’s Minister of Finances from 1665 to 1683.

11. Thomas Jefferson to Horatio G. Spafford, 1814. The Writings of Thomas Jefferson, Memorial Edition, (Lipscomb and Bergh, editors) Vol. 14:119.

12. Adam Smith (1999), The Wealth of Nations, Penguin Classics, London.

13. Flight of the Golden Geese (ibid.) www.flightofthegoldengeese.com